Having a smooth, streamlined point-of-sale (POS) experience is vital for firearms dealers. Research has found 62% of customers are less likely to return after a poor store experience, and 49% would tell a friend if they had a negative experience. In this post, we’ll discuss six key strategies for creating a better POS experience for customers and mention specific tools for improving the process.

1. Start with Staff Training

Above all else, start with proper staff training. Why? It will ensure that staff handling customer checkout knows what to do and can keep things flowing. Due to the compliance-heavy nature of gun selling and everything that’s involved with A&Ds and 4473s, this is often more difficult in this industry than in many others. Not only must staff be able to succinctly move customers through the checkout process, they must ensure they’re filling out the right information, properly performing NICS and state background checks, and so on. Failing to do so can potentially result in an ATF inspection and a subsequent violation if this isn’t done according to recent rulings.

That’s why you never want to hire someone and immediately “throw” them into handling complex firearms transactions. Rather, you should invest the time into training them on:

- The legalities of gun selling

- What information is required for A&Ds and 4473s

- How to correctly use your POS system

- The nuances of your system

- Customer service to prevent negative experiences

- How to prioritize customers’ needs during stressful situations

This alone can go a long way in creating a better POS experience and significantly increase your customer satisfaction rate.

2. Offer Multiple Payment Options

In the past, many firearms sellers accepted three types of payment — cash, card, or check. But today’s customers don’t want to be limited to only these payment methods, especially when you’re talking about high-value purchases like guns. According to digital firearms and outdoors resource Backfire.TV, the average cost of a gun as of 2021 was $500, so the more payment options your customers have, the better. Not only does this offer more convenience, it also speeds up the checkout process to help avoid long lines and disgruntled customers.

Besides cash, debit, and credit payments, for instance, you should consider accepting mobile payments. Research has found “three out of five US smartphone users have a mobile wallet, but as of October 2018, only half of retailers accepted mobile payments.” Doing so can give you an instant competitive advantage over many other firearms sellers and should help you win over more customers.

You may also want to consider contactless payments where users tap-and-pay rather than having to swipe their card or use a chip and PIN code. This really caught on when COVID reached its peak, but it’s still nice to have post-COVID and makes for a nice in-store payment option. Beyond that, consider PayPal and even cryptocurrency, as this is becoming increasingly common in retail settings.

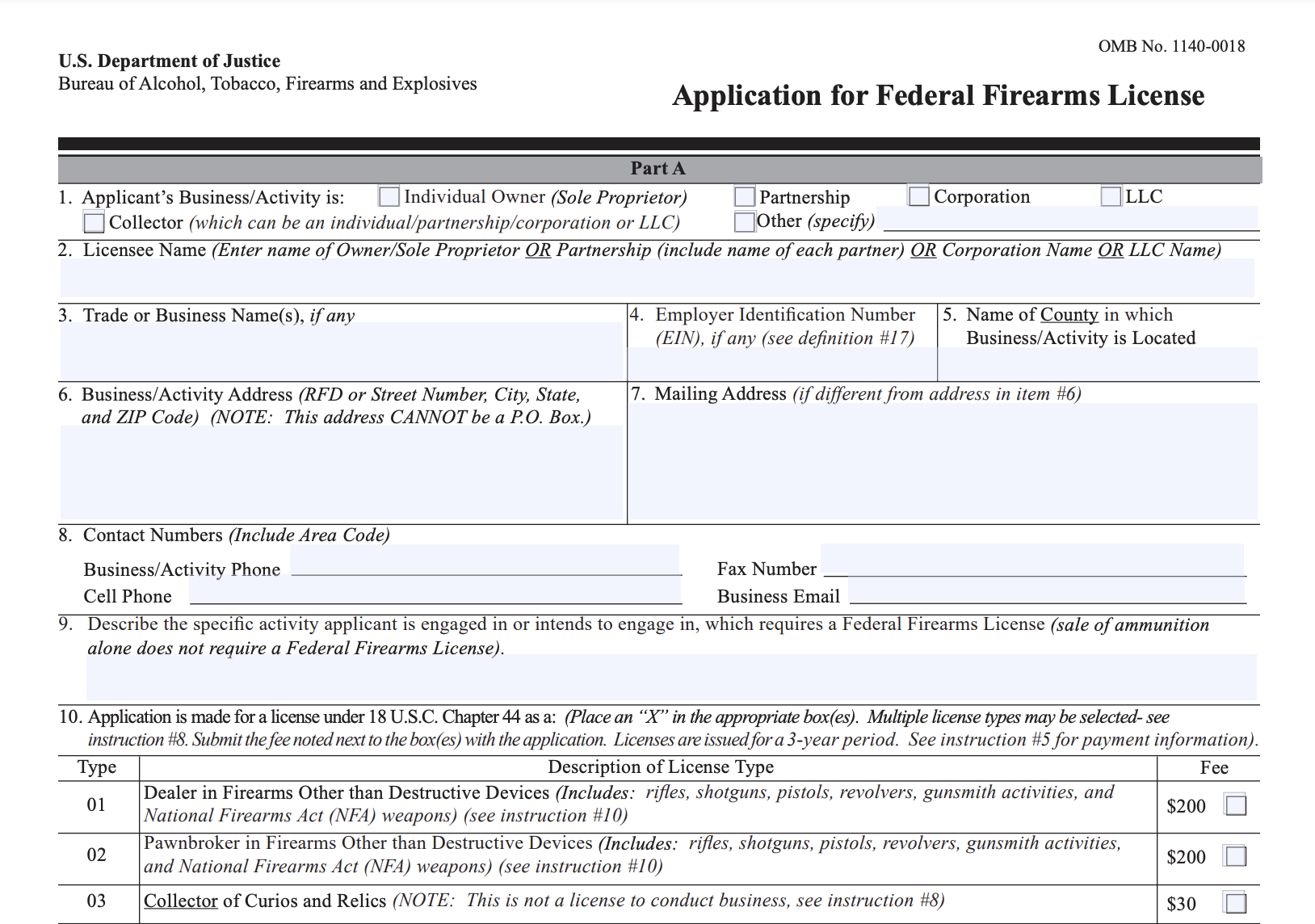

3. Integrate FFL Software

As you’re probably well aware, maintaining your FFL bound book is not easy but is required to stay compliant and essential for keeping a good relationship with the ATF. For the disposition part of your bound books, you must include several pieces of important information from form 4473, including the disposition date, name, address and form 4473 serial number if filed numerically(TTSN).

If you’re doing this the “old-fashioned” way with paper forms, it can be slow-going where you get so caught up trying to complete one transaction, you end up neglecting other customers and creating friction in the checkout experience. That’s why a growing number of firearms sellers are now integrating FFL software into the POS process.

Rather than meticulously filling out paper forms, FFL software allows you to do everything digitally while ensuring full compliance based on recent ATF rulings. FastBound, for example, lets you create unlimited bound books with ease in an electronic format so you can accurately record information and rapidly move through the checkout process without clogging it up.

And for 4473s, FastBound lets you turn any computer, tablet, or smartphone into a fully compliant 4473 form and comes with digital signature support and digital storage.

You simply add the firearm, the buyer fills out their portion of the 4473 and electronically signs it. You then perform the background check and complete your sections, and you’re on to the next sale. That way you can keep the checkout moving and can avoid creating unnecessary friction points for your customers. And because of the digital font, you can avoid handwriting legibility issues that were so common in the past.

4. Automate Background Checks

Another helpful feature of FFL software is that it can be used to automate the National Instant Criminal Background Check System (NICS) and many state background checks. With FastBound, for instance, you can conveniently check the federal NICS to verify the buyer doesn’t have a criminal record and is eligible to buy a firearm.

You can also easily check multiple state background systems, including phone-in states like Nevada to move through the process quickly and efficiently. In turn, you’re able to ensure full compliance and guns don’t end up in the wrong hands while at the same time streamlining what has historically been an onerous part of the POS process.

5. Use Compliance Warnings

Besides streamlining A&Ds and 4473s and automating background checks, some FFL platforms like FastBound also feature built-in compliance warnings that will alert you whenever there’s a potential issue during dispositions. Some of the most common reasons for violations are failing to complete forms as prescribed or failing to maintain accurate transaction records.

It’s understandable, given all the information you need to record and the fact that ATF regulations are continually changing. With built-in compliance warnings, however, FastBound detects any aberrations in the system that could be out of compliance and will instantly let you know. That way you can make the necessary adjustments to avoid problems without having to manually sift through the details.

6. Leverage POS Analytics

Studies have found a clear correlation between using business analytics and long-term success. According to McKinsey, “companies that effectively use analytics are 6.5 times more likely to retain customers, 7.4 times more likely to outperform their competitors, and nearly 19 times more likely to achieve above-average profitability.”

Today’s analytics can be applied to nearly every aspect of operations, and POS is no exception. Here are just a few possibilities:

- Monitoring peak sales times to ensure you’re always adequately staffed to keep up with customer demand

- Identifying which firearms and other types of inventory have the most demand to fine-tune ordering

- Determining which forms of payment are the most popular

- Tracking staff performance to ensure you’ve got the right people working for you

You can find a list of the top POS analytics platforms here for quick reference and a breakdown of their key features.

Final Thoughts: Creating a Better POS Experience

A smooth, streamlined checkout for firearms sellers is essential.

Because of the need for accurate record-keeping and diligent ATF compliance, it’s easy for friction to occur. But using the six strategies outlined above and using innovative technology like FFL software and POS analytics should help you dramatically reduce inefficiencies and keep your checkout flowing.